What is an IRA account? All about IRAs

If you're like most investors, retirement is one of your major financial goals. However, the road toward retirement can often seem overwhelming and confusing — especially regarding the many types of retirement accounts you can use to invest. An individual retirement account (IRA) is a tax-advantaged account you can use in conjunction with other retirement accounts to save more money toward your golden years.

What is an IRA, and how does it work? What can I do with an IRA account, and how does an IRA account vary from other major retirement investing accounts? If you're an investor asking these questions, you're not alone. Read on to learn the answer to “What is IRA?” and IRA retirement investment options. We'll also review what to do with IRA money when investing independently.

What is an IRA?

An IRA is a type of investment account designed to help individuals save for retirement. IRAs were introduced as an additional retirement savings vehicle in 1974 as part of the Employee Retirement Income Security Act (ERISA). The same legislation created 401(k) plans. Both accounts have similar benefits. You can open an IRA through a major brokerage account provider like Vanguard, T.D. Ameritrade and Charles Schwab.

Like a 401(k), any IRA investment, even a gold IRA, will have benefits when you file taxes or when you withdraw funds in retirement. There are multiple types of IRA accounts, with variations between accounts mainly coming down to contribution limits and when you are taxed on the investments you contribute to the account.

Why invest in an IRA?

Now that you understand "What is an IRA account?", you might wonder why you need one. Multiple benefits come with investing through your IRA, including the following.

- Tax advantages: Depending on your IRA type, you can make tax-deductible contributions, reducing your total taxable income for the year. If you must pay taxes on your contributions, you can tax distributions tax-free.

- Investment flexibility: You can choose from various investment options, including individual stocks and bonds, mutual funds and ETFs. An IRA can provide greater flexibility if your primary retirement account is an employer-sponsored 401(k).

- Can provide higher contribution limits: Investors can invest using an IRA and a 401(k). If you've maxed out your 401(k), an IRA can help you take advantage of more tax benefits.

Types of IRAs

There are multiple types of IRAs, and the type of account that you open will determine when you can take tax benefits from your contributions and how your plan is managed. You'll see the following are the most common IRA options as you shop.

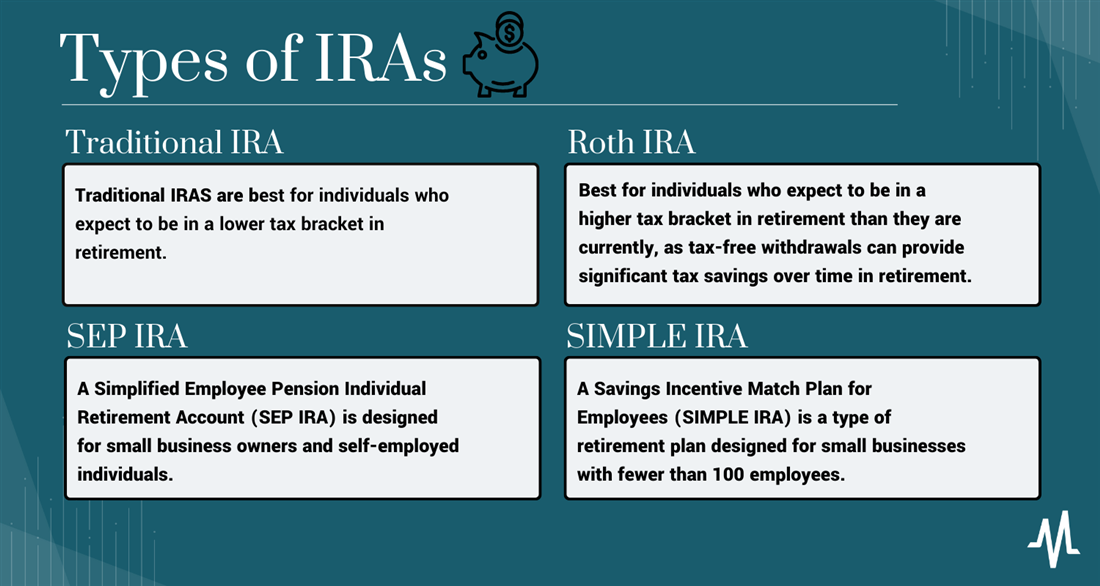

Traditional IRA

A traditional IRA is one of the most common types of IRA. With a traditional IRA, you can deduct your contributions from your annual taxable income. This can reduce your tax bill and provide an immediate tax benefit for contributing to the account by reducing the amount of money you must pay taxes on when you file.

Traditional IRAs are best for individuals who expect to be in a lower tax bracket in retirement than they are currently. The tax deduction for contributions provides an immediate benefit for reducing taxable income, and the taxes on withdrawals in retirement may be lower if you are in a lower tax bracket.

Roth IRA

A Roth IRA is an individual retirement account offering tax-free growth and retirement withdrawals. You contribute to a Roth IRA with after-tax dollars, so there is no immediate tax deduction.

However, the money in the account grows tax-free, and withdrawals in retirement are also tax-free. Roth IRAs are best for individuals who expect to be in a higher tax bracket in retirement than they are currently, as tax-free withdrawals can provide significant tax savings over time in retirement.

SEP IRA

A Simplified Employee Pension Individual Retirement Account (SEP IRA) is designed for small business owners and self-employed individuals. With a SEP IRA, the employer makes contributions to the account on behalf of eligible employees, which are tax-deductible for the employer. SEP IRAs differ from other types because they have higher contribution limits, allowing employers to make larger contributions to the account.

SIMPLE IRA

A Savings Incentive Match Plan for Employees (SIMPLE IRA) is a type of retirement plan designed for small businesses with fewer than 100 employees. With a SIMPLE IRA, both the employer and the employee can make contributions to the account, and these contributions are tax-deductible for the employer and tax-deferred for the employee. The contribution limits for SIMPLE IRAs are lower than for other retirement accounts but still higher than for traditional or Roth IRAs.

|

Account type |

Best for |

Annual contribution limit |

Tax benefits |

Required distributions |

|

Traditional IRA |

Anyone whose income will likely be lower in retirement |

$7,000 up to age 50 |

Deduct up to 100% of contributions during annual tax year |

Beginning at age 73 |

|

Roth IRA |

Anyone whose income will likely be higher in retirement |

$7,000 up to age 50 |

Contribute with post-tax income; non-taxable in retirement |

None |

|

SEP IRA |

Freelancers and the self-employed |

The lesser of 25% of the first $345,000 of compensation or $69,000 |

Investment income is tax-deferred |

Beginning at age 73 |

|

SIMPLE IRA |

Small employers and business owners |

$16,000 up to age 50 |

Money grows tax-deferred until distributions |

Beginning at age 73 |

Investment options within an IRA

An individual retirement account (IRA) offers many investment choices. The key to building a successful IRA investment portfolio lies in diversification, asset allocation and risk management. Let's explore some of these.

Stocks: Investing in individual stocks lets you own shares of specific companies. Stocks have the potential for high returns but also come with higher risks. Diversify your stock holdings across different sectors and company sizes to mitigate risk.

- Bonds: Bonds are debt instruments issued by governments, municipalities and corporations. They provide a fixed income stream and are generally lower-risk investments compared to stocks. Bonds can help balance the risk in your portfolio and provide a steady income stream.

- Mutual funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds or other assets. They offer instant diversification and are managed by professional fund managers. You can choose from various types of mutual funds, including equity funds, bond funds, index funds and target-date funds.

- Exchange-traded funds (ETFs): Like mutual funds, ETFs pool money for a diversified portfolio. However, ETFs trade on stock exchanges like individual stocks. They offer diversification, flexibility and potentially lower expense ratios than mutual funds.

- Real estate investment trusts (REITs): REITs allow you to invest in real estate without directly owning properties. They generate income from rental properties, mortgages or real estate-related assets. REITs offer diversification, potential income and the possibility of capital appreciation.

- Commodities: Commodities like gold, silver, oil and agricultural products can offer diversification and act as a hedge against inflation. You can invest in commodities through ETFs or mutual funds that track commodity indexes.

Asset allocation involves dividing your investment portfolio across different asset classes, such as stocks, bonds and real estate, based on your risk tolerance, investment goals and time horizon. It helps balance risk and potential returns. By diversifying your holdings across various asset classes, you reduce the impact of any single investment's performance.

Risk management is crucial when you're trying to create a well-balanced IRA investment portfolio. It means assessing and managing the risks of each investment. You must also regularly review and rebalance your portfolio based on your changing circumstances and market conditions.

How does an IRA work?

Like any retirement plan with tax advantages, there are rules that you need to follow when contributing and taking distributions from an IRA. You must follow major regulations when setting up and managing your IRA to avoid fees and penalties.

Deduction limits

IRA deduction limits refer to the maximum amount of money you can contribute to an IRA each year and still be eligible for a tax deduction. The deduction limits for traditional IRAs are based on your income and tax filing status.

If you are single for the 2023 tax year, you can take a full contribution deduction if your modified adjusted gross income (MAGI) is $73,000 or less. The deduction amount decreases as your income increases, and you are not eligible for a deduction if your income is above $83,000.

Contribution limits

Contribution limits refer to the maximum amount of money you can contribute to an IRA in a given year. The IRS sets the contribution limits for IRAs, which can change yearly depending on factors like inflation. The IRA contribution limit for 2024 is $7,000 for those under 50. If you're 50 or older, you may contribute up to $8,000 to your IRA in 2024.

Rollovers

If you want to consolidate multiple retirement accounts, consider a rollover. During an IRA rollover, you move money and assets from one retirement account to another. An IRA rollover must be supervised due to the tax-advantaged status of these accounts.

What is the IRA rollover process? To initiate an IRA rollover, contact the financial institution that holds your current retirement account and request a direct rollover to the new IRA account. The financial institution will then send the funds directly to the new IRA account, which can help to avoid taxes and penalties. This Roth IRA calculator from MarketBeat can help you choose where to open your account to save as much as possible.

Distributions

What is an IRA distribution? When you take an IRA distribution, you dissolve a portion of the assets in your account and take cash out for living expenses. You can take distributions anytime, but they are subject to certain rules and regulations depending on your IRA type.

For example, if you have a traditional IRA, distributions are subject to federal income tax, and you may also be subject to a 10% penalty if you withdraw funds before age 59 1/2. For Roth IRAs, distributions are tax-free if you have held the account for at least five years and are 59 1/2 when you take the distribution. Consult with a retirement professional if you're approaching retirement age and need advice on when to take distributions.

Withdrawals and distributions

Withdrawals from IRA accounts are subject to specific rules, which you must understand to avoid penalties and make informed decisions. Let's dive in.

Traditional IRA withdrawals

- Age rule: Generally, you can start taking penalty-free withdrawals from a traditional IRA once you reach the age of 59½. These withdrawals are subject to income tax based on your tax bracket.

- Required minimum distributions (RMDs): Starting at age 73 (as of 2024), you must take RMDs from your traditional IRA each year. The RMD amount is calculated based on your account balance and life expectancy. Failure to take RMDs can result in significant penalties.

Roth IRA withdrawals

- Age and account age rules: Contributions to a Roth IRA can be withdrawn tax-free at any time. For earnings to be withdrawn tax-free, the account must be open for at least five years and the distribution must be taken after age 59½.

- No RMDs: Unlike traditional IRAs, Roth IRAs don’t have RMD requirements during the account holder's lifetime. This flexibility means potential tax-free growth and the ability to pass on the account to heirs.

Penalties and exceptions for early withdrawals

- Early withdrawal penalty: If you withdraw funds from a traditional IRA before age 59½, you generally face a 10% early withdrawal penalty on top of the income tax owed. This penalty is separate from any income tax liability.

- Exceptions to the penalty: The IRS allows certain exceptions to the early withdrawal penalty, including qualified higher education expenses, first-time homebuyer expenses, unreimbursed medical expenses and certain situations involving disability or death.

Strategies for optimizing distributions during retirement

- Consider tax planning: Evaluate your tax situation and determine the most tax-efficient way to withdraw funds from your IRA. This may mean managing your income to stay within specific tax brackets or taking advantage of deductions and credits.

- Utilize a systematic withdrawal strategy: Develop a withdrawal plan that provides you with a regular income stream while considering factors such as your retirement goals, life expectancy and investment returns. Options include fixed-dollar withdrawals, percentage-based withdrawals or utilizing the IRS's RMD rules.

- Roth conversion strategies: Consider converting some or all of your traditional IRA funds into a Roth IRA. This can provide tax-free withdrawals in retirement and potentially reduce your RMDs.

- Coordinate Social Security benefits: Coordinate your IRA withdrawals with your Social Security benefits to optimize your retirement income. Delaying Social Security benefits can increase the amount you receive in the future.

- Consult with a financial advisor: See a qualified financial advisor who can help assess your individual circumstances, goals and tax situation. They can provide personalized strategies to optimize your IRA distributions.

Tax advantages of IRA accounts

Both traditional and Roth IRAs offer tax advantages. Let's explore.

Traditional IRA tax advantages

Traditional IRA tax advantages include:

- Tax-deductible contributions: Contributions made to a Traditional IRA are often tax-deductible, meaning you can deduct the amount of your contribution from your taxable income in the year of the contribution. This can potentially lower your current tax liability.

- Tax-deferred growth: Once the funds are in a traditional IRA, they can grow tax-deferred. This means you won't owe taxes on the earnings and investment gains within the account until you make withdrawals.

- Taxable withdrawals: When you withdraw funds from a traditional IRA, those withdrawals are generally treated as ordinary income and are subject to income tax at your applicable tax rate at the time of withdrawal.

- Required minimum distributions (RMDs): Starting at age 73 (as of 2024), you must begin taking RMDs from your traditional IRA. The RMD amount is calculated based on your account balance and life expectancy. These distributions are taxable and must be taken annually to avoid substantial penalties.

Roth IRA tax advantages

The tax advantages of a Roth IRA include:

- Tax-free qualified withdrawals: Contributions to a Roth IRA are made with after-tax dollars, meaning they are not tax-deductible. However, qualified withdrawals from a Roth IRA in retirement are tax-free, including both contributions and earnings.

- Tax-free growth: Like a Traditional IRA, the investments within a Roth IRA can grow tax-free. You don't owe taxes on the earnings and investment gains within the account as long as you meet the requirements for qualified withdrawals.

- No RMDs: Unlike traditional IRAs, Roth IRAs don’t have RMD requirements during the account holder's lifetime. This gives flexibility in managing your withdrawals and potentially allows for continued tax-free growth.

Pros and cons of IRAs

Now that you understand the "What's an IRA?" nuances, how it works, and the financial contributions you can make in a year, it's time to consider investing to meet your goals.

As an investor, you have a limited amount of capital you can invest in each account. Consider the pros and cons of investing through an IRA before opening an account.

Pros

The benefits include:

- Tax benefits: No matter what type of IRA you open, you'll enjoy tax savings compared to other account types. For example, your contributions can reduce your annual taxable income with a traditional IRA.

- More control over investment choices: If you open a self-directed IRA, you can choose your individual investments to include in the account.

- Flexibility: Most investors will still qualify for an IRA even if they have multiple other retirement accounts. For example, you might invest primary retirement savings into a 401(k), shop media sentiment stock lists through a taxable account and add extra tax-advantaged investments to an IRA.

Cons

The downside includes:

- Withdrawal restrictions: IRAs have restrictions on when and how you can withdraw money without penalties, which can limit your access to your funds.

- Limited investment options: Depending on the financial institution that holds your IRA, your investment options may be limited to certain assets or mutual funds. If you're primarily interested in buying and selling stocks trending in the media, an IRA might not be your best investment option.

- Contribution limits: IRAs have contribution limits as low as $7,000 annually, limiting the amount of money you can save for retirement each year.

How to get an IRA

Opening an IRA is relatively easy compared to other retirement accounts. To open an IRA, use the following basic steps.

Consider account type

First, decide which type of IRA is best for you based on your financial goals and tax situation. Most IRA providers offer multiple accounts, so choose your account type first.

Select a broker

Once you've decided on the type of IRA you want to open, choose a financial institution that offers the type of IRA you want. In most cases, this will be a broker that offers other financial services. Fill out the application provided by the financial institution—most brokers now approve IRA applications filed online instantly.

Fund your account

After you establish your account, browse your broker's available IRA investment. Depending on where you've opened an account, you may be unable to buy and sell individual shares of stocks. Review fund and account fees before placing a purchase order, and monitor how your investment changes over time.

Common myths and misconceptions about IRA accounts

There are many myths and misconceptions people have surrounding IRAs. Here, we address a few of them to bust the myths.

Myth 1: IRAs are only for the wealthy.

IRAs are not exclusive to high-income people and are accessible to a broader demographic. Here are some clarifications:

- Contribution limits: IRAs have annual contribution limits set by the IRS. These limits apply regardless of income level.

- Tax benefits for all income levels: Both traditional and Roth IRAs offer tax advantages, regardless of income. Traditional IRAs provide tax-deductible contributions, offering immediate tax benefits if you’re eligible. While not providing immediate tax deductions, Roth IRAs offer tax-free retirement withdrawals, making them attractive for any income level.

- Accessible investment choices: IRAs provide a range of investment options, including stocks, bonds, mutual funds, ETFs and more. With these, you can tailor your investment strategy based on your risk tolerance, goals and financial situation.

- Long-term savings and compound growth: IRAs encourage long-term savings and benefit from the power of compound growth. Starting early and consistently contributing to an IRA, even with a modest income, can accumulate substantial retirement savings over time.

- Flexibility and portability: IRAs offer flexibility and portability, allowing you to contribute to an IRA even if you have employer-sponsored retirement plans like 401(k)s.

Myth 2: All IRAs are created equal.

Traditional and Roth IRAs are not the same.

They have distinct features and tax implications. Traditional IRAs offer tax-deductible contributions but tax withdrawals in retirement, while Roth IRAs don't provide immediate tax benefits but offer tax-free withdrawals. When choosing between the two, consider current and future tax rates, eligibility and income limits, required minimum distributions and long-term tax considerations.

Myth 3: I'm too old to open an IRA.

There's no maximum age limit for opening or contributing to an IRA. You can still open and contribute to traditional or Roth IRAs if you have earned income.

If you're 50 and older you also have a catch-up contribution allowance, where you can contribute more than the standard limit. Both traditional and Roth IRAs continue to offer tax advantages for older people, like tax deductions and tax-free withdrawals. IRAs can be valuable for estate planning, allowing beneficiaries to inherit the account and potentially stretch out the tax advantages.

Choosing the right IRA for you

If you're deciding between a traditional and Roth IRA, several factors come into play. Here are a few key considerations:

- Tax considerations: Contributions to a Traditional IRA are tax-deductible, potentially lowering your current taxable income. However, withdrawals in retirement are subject to income tax. Roth IRA contributions are made with after-tax dollars, so they don't provide immediate tax benefits. However, qualified withdrawals in retirement, including contributions and earnings, are tax-free.

- Contribution limits: Both traditional and Roth IRAs have annual contribution limits. These limits may change over time, though.

- Income thresholds: There are no income limits for contributing to a traditional IRA, but tax deductibility may be limited if you or your spouse participates in an employer-sponsored retirement plan. Roth IRA contributions have income limits. However, "backdoor Roth IRA" strategies exist for high-income earners to indirectly contribute to a Roth IRA.

- Future tax expectations: If you anticipate being in a lower tax bracket during retirement, a traditional IRA may be a good choice, as you receive upfront tax benefits and pay taxes on withdrawals later. If you expect your tax rate to be higher in the future or want the flexibility of tax-free withdrawals, a Roth IRA can be beneficial.

To help you choose, consider the following scenarios:

- If you anticipate a lower tax rate in retirement or want immediate tax benefits, a Traditional IRA may be suitable.

- If you expect your tax rate to be higher in the future or want tax-free withdrawals, a Roth IRA may be better.

- A Roth IRA's tax-free withdrawals can be a good choice if you're younger and have a longer time horizon for potential compound growth.

- If you're closer to retirement and seek immediate tax deductions, a traditional IRA might work better.

When selecting the right IRA, always assess your current financial situation, future tax expectations and retirement goals. Consulting with a financial advisor or tax professional can offer personalized guidance to help you make the best decision.

Investing with an IRA

Due to its lower limits on most accounts, IRAs are best used in conjunction with another type of retirement account. If you have a 401(k) that you max out annually, you can continue investing through an IRA, providing a more diverse range of tax protections.