The Rally in Lockheed Martin and RTX Can Continue: Here’s Why

Shares of Lockheed Martin (NYSE: LMT) and RTX (NYSE: RTX) are up by 40% and 80% since early 2024 and can continue to set new highs this year and next. Their businesses are thriving because of increased global demand, and they sustain growth, robust cash flow, and ample capital returns, which are primary drivers of share price action. The capital returns include dividends and share-reducing buybacks, and the capacity to return capital to shareholders grows yearly, helping sustain a robust uptrend in their stock prices expected to hit new highs in 2025.

Diversification Sustains Growth for Defense and Aerospace Businesses

Although the segment results were mixed, Lockheed Martin and RTX sustained growth in Q3. RTX outperformed on the top and bottom lines, and Lockheed only on the bottom line, but both showed sustained growth in top-line revenue and earnings and raised guidance for the year, which is a tailwind for their markets. The guidance includes increased expectations for revenue and earnings, sustaining the outlook for capital returns and dividend distribution growth, another tailwind for stock prices.

Margin news was mixed but remains solid for each, with RTX’s merger synergies continuing to drive gains. It produced leveraged bottom-line results, with adjusted EPS up 16% compared to Lockheed's low single-digit growth. Regardless, both businesses are growing, with business supported by record backlogs that are expected to continue expanding in 2025.

Cash flow is a compelling detail for investors, with the combined total in Q3 over $4 billion, including near-equal contributions from both. The combined FCF margin is near 11%, most of which is returned to shareholders. The combined capital return, including dividends and share repurchase, is $2.7 billion, with repurchases reducing share counts by mid-single digits and dividend yields running near 2%. Balance sheet highlights from Q3 include increasing cash, assets, and equity, with equity up by low single digits and expected to grow over the next five quarters.

Both defense stocks are well-known for increasing distributions annually. With its Q3 report, Lockheed announced a 5% increase in dividend payment and share repurchase authorization. The new authorization puts the total allotment over $10 billion, sufficient to reduce the market cap by more than 7.5%, with shares near $575. RTX is on track for its next annual distribution increase in late spring 2025. Dividend distribution growth is expected to continue at a mid-single-digit CAGR.

Analysts Sentiment Is a Tailwind for These Companies

Analysts' sentiment trends support aerospace and defense stocks like Lockheed Martin and RTX in 2024. The revision trend continued to lift the price targets for each following the Q3 releases. LMT is pegged at a Moderate Buy, with sentiment improving over the past year. RTX holds a Hold rating, but only RTX is forecasted to advance significantly, with analysts projecting a 30% upside following Q3 releases. Meanwhile, Lockheed Martin’s sentiment narrowed, suggesting a smaller potential gain above the current consensus.

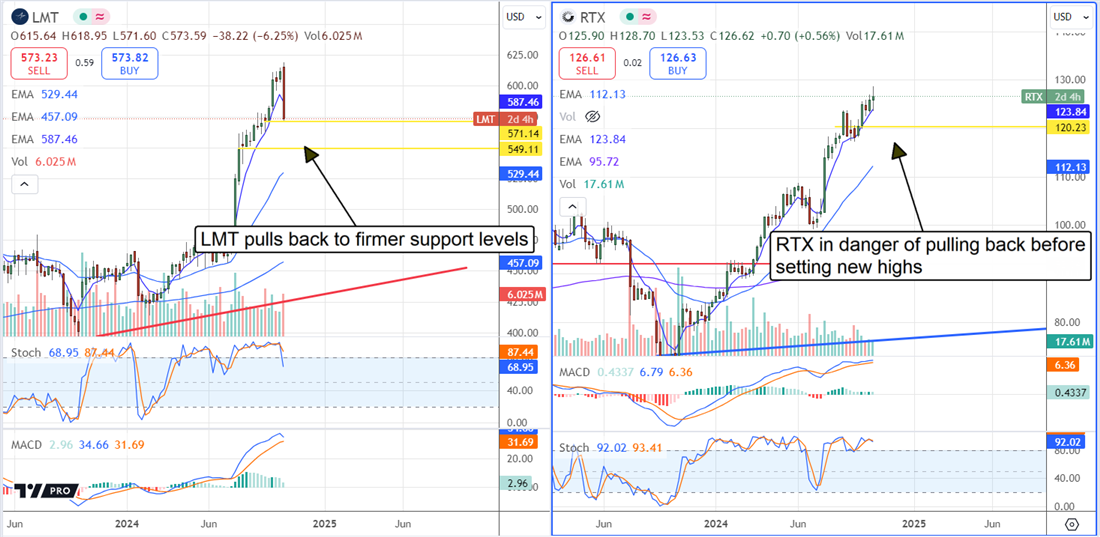

Lockheed Martin Pulls Back: RTX At Risk of Same

The price action in LMT shares pulled back more than 5% following the Q3 release, setting up a buying opportunity that the market will likely confirm before the end of the year. Shares of RTX held steady, trading at all-time high levels, but are in danger of the same. The market shows indecision and may follow the leader to lower prices before extending the trend to set more new highs. Lockheed may fall to $560 or lower before it finds support; RTX’s primary support targets are near $120 and $110.

The risk for investors is the institutions. The institutions own 75% and 85% of Lockheed Martin and RTX and have been selling on balance all year. The headwind decreased in Q2 and Q3 but is persistent and could cap gains. However, a price pullback such as the one presented by LMT could entice them to buy and strengthen the tailwinds for these markets.