Super Micro Computer Shares Surge on Compliance News

Super Micro Computer (NASDAQ: SMCI) is a prominent player in the high-performance computing solutions sector and the company is experiencing a significant surge in its stock value. On February 25, 2025, Super Micro Computer filed its overdue annual report for the fiscal year 2024 (FY2024) and quarterly reports for the first and second quarters of the fiscal year 2025 (FY2025).

This action has triggered a positive reaction in the market, with premarket trading up over 20%, suggesting a strong restoration of investor confidence as the company addresses and resolves prior compliance concerns. The market's response underscores the significance of regulatory adherence and the renewed focus investors can now place on Super Micro's core business and prospects.

From Uncertainty to Clarity: The Road to Filing Completion

The recent positive movement in Super Micro Computer's stock follows a period of uncertainty related to delayed financial reporting. The company faced challenges in completing its annual report for the fiscal year concluding June 30, 2024, resulting in a notification from NASDAQ regarding non-compliance with listing requirements. Specifically, Super Micro did not meet the deadline for filing its Form 10-K, which was initially due on August 29, 2024.

This delay prompted NASDAQ to issue a letter indicating that Super Micro was not in compliance with NASDAQ listing rule 5250(c)(1), which mandates the timely filing of reports with the U.S. Securities and Exchange Commission (SEC).

Super Micro's Board of Directors took decisive action in response to these reporting delays by forming an Independent Special Committee. This committee was tasked with investigating matters related to financial reporting and compliance issues. The formation of this committee and the subsequent delay in filings introduced a degree of ambiguity surrounding the company's financial status and internal controls.

This period of uncertainty acted as an overhang on the stock, as investors awaited clarity on the situation and the resolution of the compliance matters. The successful filing of the overdue reports effectively lifts this cloud of uncertainty, allowing investors to reassess the company based on its operational strengths and market opportunities.

Relief Rally and Restored Confidence

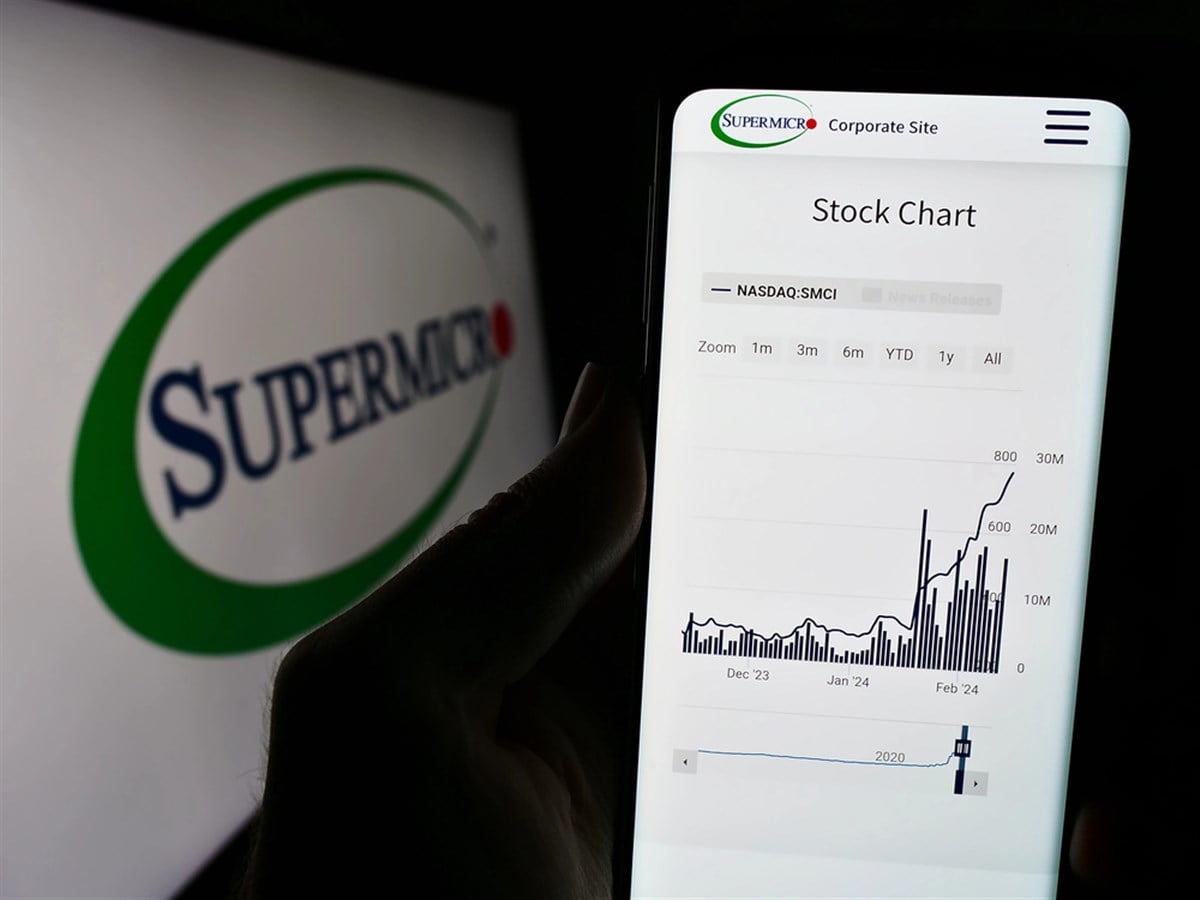

The market's reaction to Super Micro's completed filings initiated a relief rally. The approximate 20% surge in premarket trading on February 26, 2025, reflects a strong wave of renewed investor confidence. This positive price movement is further emphasized by the substantial trading volume observed on February 25, 2025, where 139.34 million shares changed hands, nearly double the average volume of 73.56 million shares.

This heightened trading activity, and price increase suggest that investors who were previously hesitant due to the compliance concerns are now returning to the stock, reassured by the resolution of the filing delays and the regained NASDAQ compliance.

The market perceives the completion of the financial filings as a critical step forward for Super Micro. It signifies the company's commitment to regulatory standards and provides transparency regarding its financial standing. By addressing the compliance issues, Super Micro has removed a significant impediment that was weighing on investor sentiment.

The market's response indicates a belief that Super Micro can now refocus its efforts on its core business operations and capitalize on the substantial growth opportunities within its target markets.

Super Micro Positioned for Expansion After Compliance Milestone

With the successful resolution of its financial reporting obligations, Super Micro Computer is now "cleared for takeoff," poised to implement its ambitious growth strategy fully. CEO Charles Liang emphasized this sentiment in a recent statement: "Today’s filings represent an important milestone. With financial reporting now current, focus can fully shift towards executing a proven winning growth strategy."

This strategy is underpinned by technological innovation, rapid product development cycles, a global operational footprint, and a commitment to environmentally conscious "green computing" solutions.

Super Micro operates as a total IT solution provider, concentrating on key growth sectors including Artificial Intelligence (AI), cloud computing, storage solutions, and 5G/Edge infrastructure. The company's strategic focus aligns directly with areas experiencing exponential growth in the technology sector.

By resolving compliance concerns, Super Micro eliminates a significant distraction and can now channel its resources and management attention toward capturing increasing market share within these high-demand sectors. The regained compliance acts as a catalyst, enabling Super Micro to confidently pursue its revenue targets and solidify its position as a leading innovator in the IT infrastructure space.

The company's goal of reaching $40 billion in revenue for fiscal year 2026 underscores its growth trajectory, which is further empowered by the resolution of the prior compliance challenges.

Targets, Guidance, and Future Projections

Super Micro Computer's financial outlook reinforces the positive narrative surrounding its growth prospects. The company's updated fiscal year 2025 revenue guidance projects a substantial range of $23.5 billion to $25 billion, signaling significant year-over-year expansion.

The ambitious fiscal year 2026 revenue target of $40 billion demonstrates strong management confidence in sustained growth momentum. While preliminary financial highlights for Q2 fiscal year 2025 indicate healthy net sales and profitability, the Q3 fiscal year 2025 guidance also points toward continued revenue growth and positive income per share.

Analyst perspectives, while currently reflecting a consensus Hold rating, suggest a potential upside in stock valuation. The average analyst price target of $60.73 indicates a possible 33% increase from the recent closing price of $45.54. Notably, some analyst price targets range as high as $135.00, suggesting a belief in considerably greater appreciation.

This range in analyst price targets may reflect differing assessments of risk and future execution, but the average target nonetheless indicates a positive outlook on Super Micro's stock performance. As Super Micro continues to execute its growth strategy and demonstrate financial stability following the resolution of its compliance matters, there is potential for analyst sentiment to become increasingly bullish, possibly leading to upgrades in ratings and price target revisions.

Super Micro's Future in the AI Era

Super Micro Computer's successful navigation of recent compliance hurdles and its subsequent stock surge signal a company "cleared for takeoff." With financial reporting now current and NASDAQ compliance regained, Super Micro is strategically positioned to capitalize on the growing demand for AI infrastructure and high-performance computing solutions.

The company's technological prowess, particularly in direct-liquid cooling, coupled with its focus on key growth markets, provides a strong foundation for future expansion. As Super Micro executes its ambitious growth strategy and leverages its core strengths, the company appears poised for continued ascent within the sector, offering a compelling narrative for investors looking toward the AI-driven future.

Learn more about SMCI