Conviction Firms for Microsoft's Double-Digit Stock Upside

Microsoft (NASDAQ: MSFT) shares are falling, and this is a buy-the-dip opportunity. The Q4 results failed to spark a rebound in share prices but give no reason to shed a position and every reason to believe a double-digit upside will come soon. The biggest concern from the report is that growth just isn’t as hot as it could be. It’s hot, supported by all segments and AI, guidance is decent, and we’re still in the early stages of a secular tech upcycle, so the long-term rally in share prices will likely continue.

The analysts' activity following the release is mixed, and most revisions are reduced price targets but don’t read too much into that. Price targets are coming down but narrowing into a range above the current consensus estimate. The range of new targets runs from $475 to $550, with the $550 target a re-affirmed target from Wedbush. The average and median of these new targets are near $500, which are significant targets for technicians.

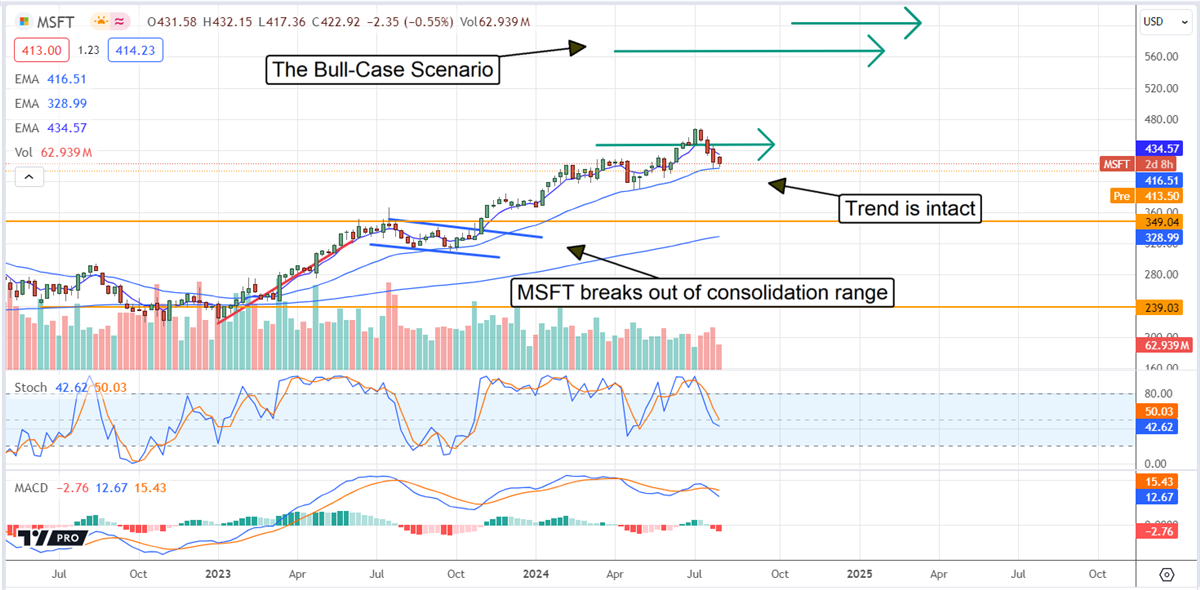

A move to the $500 level would set a new all-time high, confirming a major uptrend in the stock price. However, this is a low estimate compared to the longer-term target. The stock price broke out of a multi-year consolidation late in 2023, and a move to new highs would bring the bull-case scenario of MSFT near $600 closer to reality.

Microsoft Outperforms, Guidance is Good; Buy the Dip

Microsoft’s shares fell following the Q4 release and guidance because analysts got what they wanted and nothing more. The takeaway is that Q4 revenue grew by 15.1% YoY and outperformed the consensus target reported by MarketBeat by 40 basis points. Growth was seen in all segments, with Intelligent Cloud up 19%, followed by a 14% gain in More Personal Computing and an 11% increase in Productivity and Business Processes.

Digging deeper, all subsegments but one produced growth; the single outlier is devices, which should see a rebound soon. The sub-segment that disappointed the market is Microsoft Cloud, specifically Azure, which grew by only 29%, slightly below company forecasts but strong nonetheless.

Margin is another area of strength. The company maintained its system-wide gross and operating margin to deliver a 15% operating income gain. That was cut to 10% after spending, which was still better than expected, leaving GAAP EPS at $2.95, up 10% and 68 basis points above consensus. Similarly, guidance is strong but provides no catalyst to rally. Expecting double-digit top and bottom growth in fiscal 2025, it is a hair shy of consensus.

Microsoft is Building Value for Investors

Microsoft had a negative cash flow quarter, which is the worst that can be said. The offsetting details are that cash burn was minimal, and the balance sheet was greatly improved. Highlights include reduced cash offset by increased receivables, investments, goodwill, and intangibles. Current and total liabilities are up but less than the increase in assets, leaving equity up by 30% compared to last year. Because leverage remains low at .16x equity, .08 assets, and roughly 3x cash plus receivables, it is in a strong financial position to continue capital returns and business investments.

The price action in MSFT stock is down in early trading, near the recent lows, but has not broken the trend. There is a risk that the market could fall below the $415 level and continue lower, but that is not expected. The likely scenario is that investors will buy the dip in this stock and create a trend-following signal. In that scenario, MSFT will likely retest the all-time highs later this year and may set a new high by the year’s end.